Save Africa, Think outside the box!

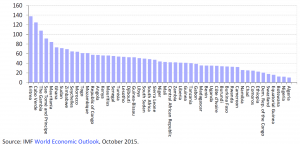

In the ten-year period between 2006—when the first Sub Saharan African (SSA) eurobond was issued—and 2016 more than a dozen African countries had racked up eurobond debt of more than $23 billion, that carries an average annual coupon payment of +/- $1.7 billion. A eurobond, also referred to as sovereign bond, is a debt security issued by a national government and is denominated in a foreign currency, usually dollar, rather than the euro that its name implies.

The African countries in seeking these alternative sources of funding ignored the bold writing on the wall which predetermined the unsustainable debt crisis of the 1980s. In the period between 1970 and 1990 African countries borrowed heavily, with their debt becoming unsustainable. The cyclical events of unsustainable debt of the 1980s, when the continent’s debt position stood at more than $270 billion, was attributed to—depending on which side of the fence you’re on—poor governance, corrupt leadership and protracted civil wars in many African countries.

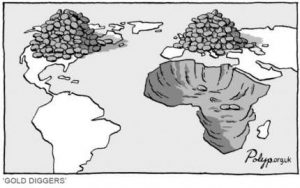

Today, the events have come full circle, and the rising debt crisis bear the same hallmarks of poor governance, unchecked corruption and political mileage investment. The single catalytic factor to trigger debt unsustainability in Africa has always been the crash of commodity prices on the global market.

In 1996, the World Bank instituted the Highly Indebted Poorest Countries Initiative (HIPC) which was aimed at “relieving the world’s poorest countries of unmanageable debt burdens”. In response to the worsening debt situation among these countries the World Bank in 1999 approved an accelerated program called Enhanced HIPC Initiative, which eased the conditions under which a country may reach “completion point” to receive debt forgiveness. This essentially was a program to “write off” bad debt.

To date the program has given debt relief to 36 countries, with 30 of them in Africa of up to $99 billion. Three African countries have still not attained the qualifying criteria to receive the full debt forgiveness and these include Eritrea, Somalia and Sudan—war and civil strife, a predominant feature among them.

The signs are ominous. Of the more than a dozen countries that have issued sovereign bonds between 2010 and 2016, nearly half of them are close to defaulting on their coupon payments or are actively seeking ways to refinance the bonds. The bonds in themselves carry an average maturity period of ten years and thus the majority of these bonds will fall due between 2020 and 2026, but the cracks in the wall have already started showing.

Four tales of caution

Mozambique: The IMF pulled its budget support for Mozambique earlier this year, when it emerged that the country had misinformed the fund about the size of its debts. It hid $1.4 billion of loans for its interior ministry and two state-controlled firms—among others. These revelations followed a scandal over the misuse of $850 million of notes issued by a state-owned company, Ematum. Investors thought they were lending the money for the purchase of a tuna-fishing fleet, when in fact the proceeds were being used for military purposes.

The IMF’s withdrawal “seriously hurt” the government’s accounts, Mozambique told investors, adding that its “primary objective is to resume relations with the IMF to stabilize the economy and restore the confidence of the international community”. Gross public debt levels have reached distress levels as a share of GDP.

Mozambique defaulted on a $60 million coupon payment in Jan 2017. This default is off a restructured $850 million bond initially issued in 2013, restructured in 2016 with a bond value of $ 757 million, issued at 10.5% interest with a 2023 maturity date. Mozambique has entered into negotiations with bond investors but is technically in default.

Zambia: It issued three eurobonds between 2012 and 2015 totaling $3billion and has been seeking a $1.6 billion IMF bailout package since late 2016. However, this has still not been approved primarily on two accounts; the country showing obvious signs of high debt risk with its debt hovering around 60% of GDP and the country’s lack of transparency to fully account for the use of at least $2.2 billion of the $3 billion it issued in Eurobonds.

Zambia’s external debt position has been mounting since 2008 following the HIPC Completion debt forgiveness when its debt position stood at just under a billion dollars to the current $7.3 billion. The country’s capacity to service its debt repayment has endured both external shocks in the slump of international commodity prices as well as domestic contractions in production due to partial drought and a power deficit that hit the country in 2015 and 2016.

Ghana: had issued a ten-year $750 million bond that was maturing in 2017. Again, the repayment solution has revolved around refinancing the bond with a 2015 $ 1 billion, 15-year new issuance bond carrying a higher coupon rate of 10.75% and supported by a $400 million World Bank guarantee. This issuance was off the backbone of another $ 750 million bond issued in 2013, for which part of the proceeds ($250 million) were used to refinance the 2007 bond, albeit at a lower coupon rate, extending the maturity period and saving the country $1.375 million in annual interest payments.

Senegal: The trend has not been any different with Senegal issuing a ten-year $500 million bond in 2011, to refinance an earlier five-year $ 200 million bond issued in 2009. The Senegalese government planned to use the $ 300 million net proceed from the bond to finance developmental infrastructure projects in the transport and energy sector.

The obvious characteristics of these eurobonds is that at any time the bonds near maturity the African countries are not just all re-financing to extend the debt repayment period, they are issuing higher bonds that allows them to gain net proceeds beyond the re-financing costs to fund their expenditure, developmental or otherwise.

The African countries who are susceptible to external shocks are all sitting on the same weakened foundation of single commodity economies, un-diversified exports, cyclical poor government policies dogged with rampant corruption, ill implemented capital projects, unabated disregard for fiscal and monetary policies and the exercising of personal interest above those of the nation.

The dark abyss at the end of this debt spiral is that the debt position continues to grow, even in times of high economic growth, underlying the fact that the borrowing is not driven by development needs.

For as long as the African countries continue to ignore the basics of prudent financial management, opting to continue increasing their debt and postponing its repayment through refinance, the writing will remain on the wall, the inevitability for a debt crisis is guaranteed whilst the dominoes continue to fall.